Recovering from COVID, addressing wealth inequality, and meeting the aims of the Green New Deal (or Real Deal in the Australian context) are all challenges our future government will inevitably face. If you, like most Aussies, haven’t swallowed the whole ‘debt doesn’t really matter’ pill as I have, but care for progressive projects, then you might be wondering how we can finance them. Electoral politics is about compromise so while the debt-debate rages on, I present you with an alternative that should satisfy conservative debt hawks and progressive voters: the gross wealth tax.

Most conceptions of the wealth tax take the form of a net rather than gross wealth tax. A net wealth tax essentially ignores an individual’s financial liabilities. So if you have $100,000 in savings but a $500,000 mortgage, your net position is negative $400,000 and have no positive taxable wealth. In contrast, your gross position is actually positive $600,000 – now we have something to work with.

We should adopt a gross wealth tax because the rich use debt to offset their tax liability. Furthermore, they can go deeper into debt than the average person because they have assets to leverage. The average person might be granted a mortgage because they have income and some savings. The rich secure loans on large businesses which they can use to expand their business to take out more loans. In other words, they use debt to finance more debt. Counterintuitively, the political and economic power of the rich comes not from what they have but from what they owe.

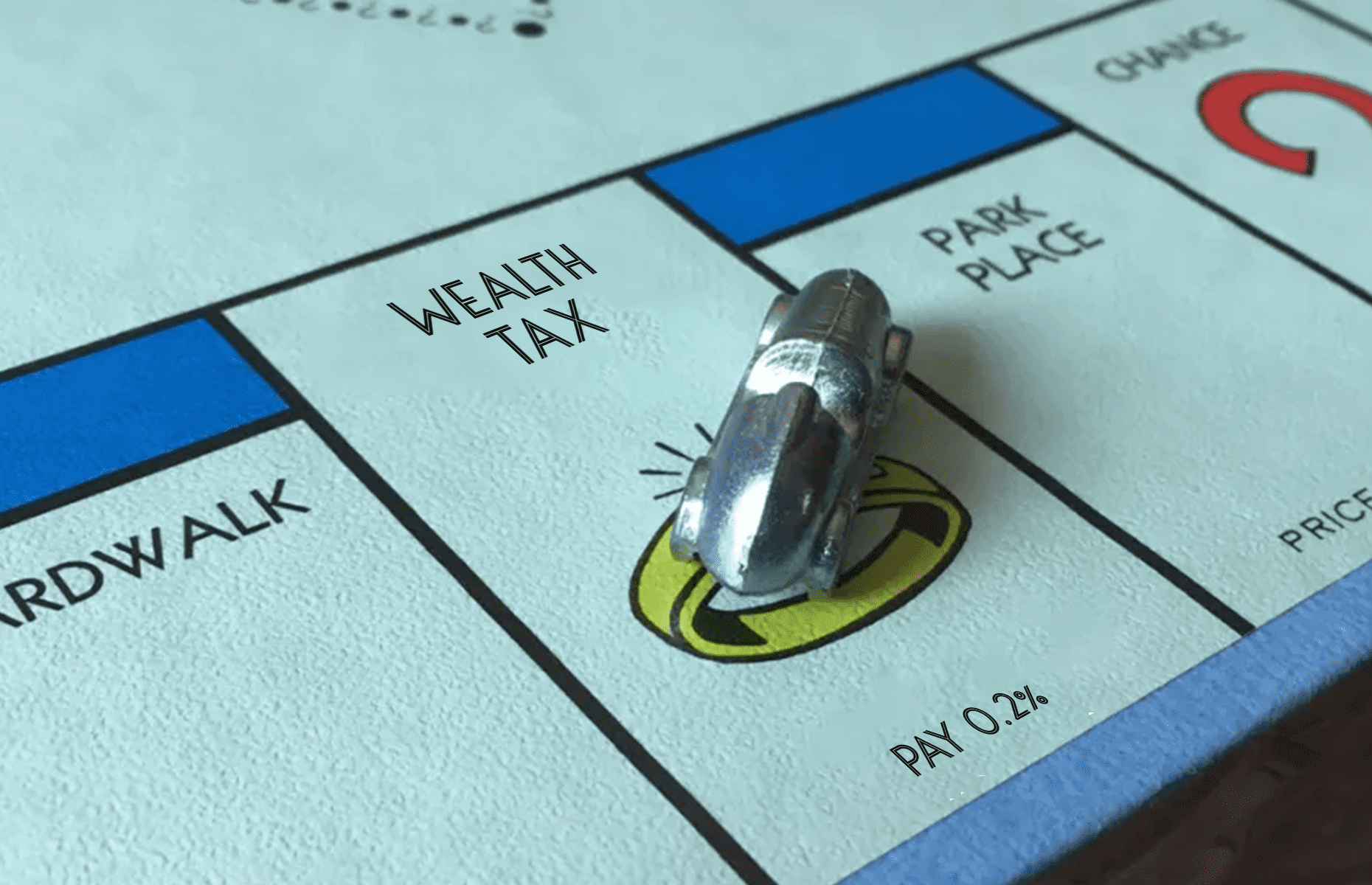

Now let’s apply the gross wealth tax to see its potential. Our current debt sits at $623 billion and the gross wealth held by Australians is approximately $26.8 trillion, according to research from the University of Sydney. At a conservative 3% interest rate on public debt, we would need a mere 0.07% wealth tax to meet all interest repayments. Meeting interest repayments is important for debt sustainability because if the interest rate is greater than the repayment rate we would see the debt balloon.

A wealth tax that is scaled to our national debt would free up income from other taxes to pay back the loan (minus interest), build infrastructure, create jobs, and care for the most disadvantaged.

One might then ask, what kind of wealth tax might be required to sustainably finance the green transition as part of the Green New Deal. Research at Stanford University found that a complete energy transition in Australia could cost anywhere up to $820 billion. They also found that if publicly owned, the money generated from energy sales would repay that amount. Therefore, to manage the interest repayments we would need a tax rate of just 0.09%. We could manage our current debt and this new debt with just a 0.16% wealth tax.

These amounts are insignificant compared to the income tax rates – tax rates often avoided by CEOs who pay themselves in other ways. They are also far lower than the rate at which wealth is growing in this country. Specifically, net wealth in Australia grows at 5.99% per year which will likely outstrip any tax rate that we would adopt, but the upper limit would need to be determined.

Finally, there is another reason we should consider a wealth tax that I previously hinted at – wealth inequality is bad. I believe a moral society limits wealth inequality for its own sake but empirical evidence suggests more unequal societies have less entrepreneurship, poorer educational attainment, and the redirection of labour to making luxury rather than essential goods, for example. Wealth inequality does not motivate others to work harder as the conservative mainstream would have you believe. A wealth tax is therefore a first step in taking back power from the rich.

So, the next time you make demands for a more equitable world, feel confident that there is a method of taxation that can support those demands – demands you should make irrespective of this election’s outcome.