This article is an extended version of the one in our week 2 print edition.

Since March, in the global tumult induced by the COVID-19 pandemic, central banks in advanced capitalist economies adopted expansionary monetary policies to save private enterprise. The transparency with which these cornucopias of billions and trillions in cheap credit and government bond buybacks were offered to businesses on a platter have not gone unnoticed and have been widely perceived as thinly-veiled corporate bailouts.

Many leftists have recognised these bailouts as evidence of the state’s Janus-faced macroeconomic policy regime, which proselytises ‘sound finance’ for the lowly proles and easy money for the ‘too-big-to-fail’ rich. This double standard, along with many others which have been exposed by the coronacrisis, have many activists, academics and politicians on the left calling to abandon the deficit-hawk mentality.

It’s understandable that there is a popular drive to rejig the conventional wisdom around budgetary spending and high public deficits. The current wave of expansionary monetary policy implicitly presents a silver bullet solution to the problems of poverty, inequality, exploitation and ecological devastation endemic to capitalist growth. Instead of spurting out financial aid to maintain the buoyancy of capital, it’s increasingly suggested that the purpose of macroeconomic policy can be inverted to save the oppressed and the planet.

Enter ‘Modern Monetary Theory’ (MMT), the new shiny thing that the more wonkish types have latched on to. MMT proponents claim that sovereign fiat currency can be printed by the government in any desired quantity until the level of money supply circulating within the economy fosters full employment. Any residual inflationary effects engendered by the excess in aggregate demand caused by an expanded money supply are to be regulated by increasing taxation or contracting public expenditure. MMT is frequently associated with proposals like the Job Guarantee (JG), which aims to realise the goal of full employment. These proposals tend to stipulate that rather than un(der)employed people receiving meagre social assistance payments, they can instead opt to work for the public sector at the minimum wage.

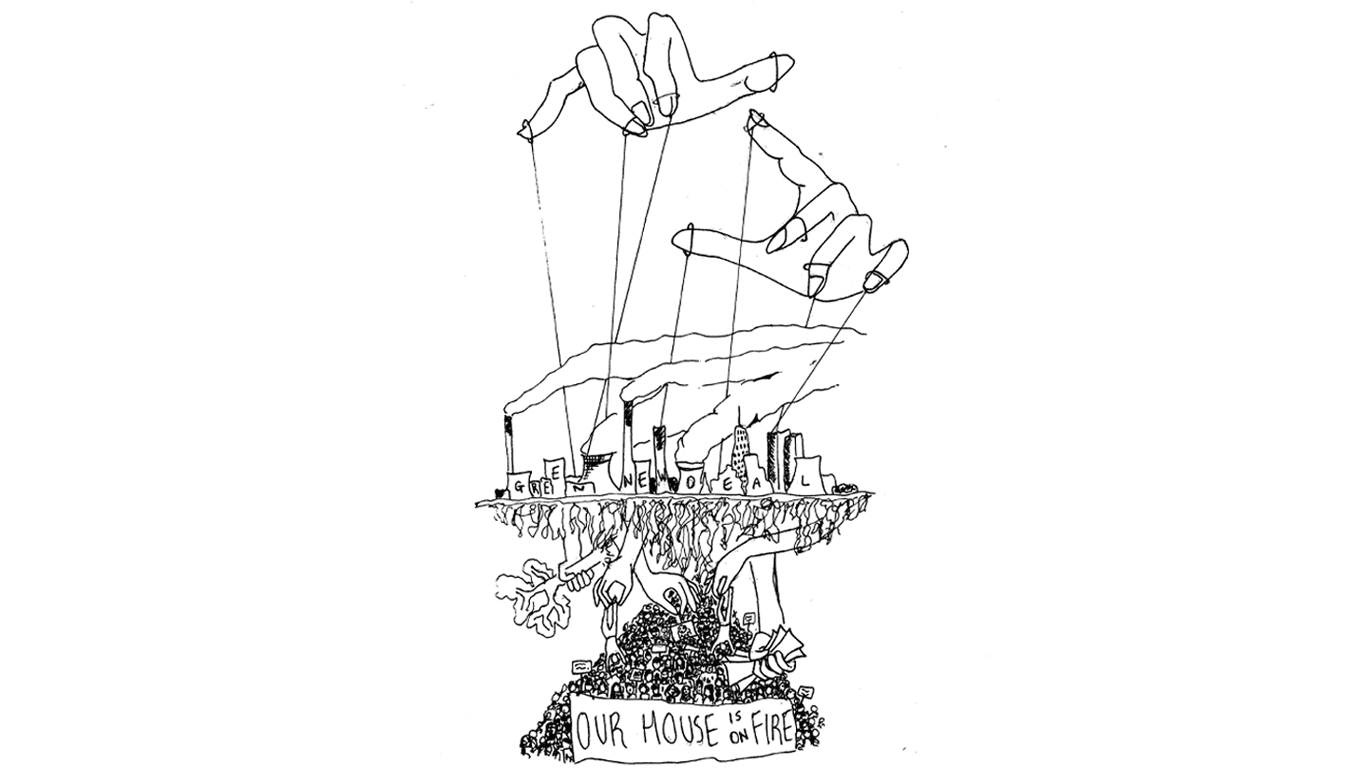

MMT has been increasingly incorporated into the ‘eco-socialist’ utopias envisioned by a coalition of environmental NGOs, social democratic politicians and progressive academics under the umbrella of a Green New Deal (GND). Currently, the GND acts as a flexible matrix of policy proposals that this woke coalition of technocratic strata justify with MMT. That is because there is a folk understanding of MMT as ‘money printer go brrr’, and the institutionalised left would need that money printer operating at warp speed to fund a GND. As a Stanford University study released December last year revealed, the estimated upfront cost of a GND for Australia would be US$820bn, or around AU$1.12tn.

The study doesn’t even factor in the cost of other progressive reforms that leftists at organisations like the Climate Justice Collective (CJC) have included in their GND wishlist, such as free university, the universal availability of free public housing, reparations for the colonial dispossession endured by First Nations peoples, substantial increases to the minimum wage and the right-to-strike.

However, the deficit-financing of a more utopian approach to the GND would soon trigger spiralling inflation and the devaluation of the Australian dollar. It’s also an approach to the GND which fiercely clashes with MMT itself, since this ensemble of policy reforms would inevitably curb productivity growth in the private sector and stimulate an excessive surge in aggregate demand. If a deficit-financed expansion of money supply causes the level of purchasing power in Australia to skyrocket, there will tend to be a stagflationary response without the restoration of a progressive profit rate. A stagflationary crisis would prompt mass insolvency and liquidation, bringing about nationwide retrenchments and sharply increasing the cost of living.

But if deficit spending increases inflation under conditions of low profitability, then why hasn’t the current wave of deficit-financed money printing provoked any inflation? This monetary expansion hasn’t triggered an inflationary response because the money wasn’t injected directly into general commodity circulation as a medium of exchange. And even when it has via JobKeeper and the Coronavirus Supplement, household consumption has slumped as real incomes still drop and stimulus is used to pay down debt. Instead of scaling-up productive investments, capital has hoarded money and absorbed government bonds to shore up strong liquidity positions under frenzied uncertainty. Rather than spurring the inflation of commodity prices in general circulation, the Reserve Bank’s policies have pumped fictitious money into financial markets and artificially inflated private equity prices to edge near pre-crash levels despite large declines in total hours worked, high rates of labour force underutilisation and business revenues which are either falling or stagnant. This is a bubble, and if the chasm between profit rates and the money supply continues to widen, it will either eventually cause inflationary devaluation or the pile-up of already unsustainable corporate debt levels. Whether now or under a GND, if the printing of money keeps outstripping the pace of (surplus) value creation in commodity production and its realisation through exchange, then a stagflationary crisis looms closer.

If many countries seriously initiate a GND-style transition to renewable energy, then it could spawn a mining boom in Australia because of the external demand for minerals needed to manufacture green technologies. Australia hosts bountiful reserves of the minerals necessary for the green energy transition, such as lithium, cobalt, nickel and rare-earth elements alongside the usual suspects like bauxite, copper and iron. This would lead to the vast multiplication of large-scale mineral extraction projects across Australia and would provide an opening for progressive fiscal policies. However, this scenario traps the left in a Catch-22 between i) financing a handful of piecemeal reforms through a prodigious intensification of mining and ii) solidarity with the Aboriginal movement for self-determination over traditional lands and resources.

The shift from fossil fuels to renewable energy will inevitably require some form of large-scale mineral extraction. However, under capitalist production this type of extraction is subsumed into the transnational circuits of flowing money and capital, energised by the exigencies that capital imposes on the production of ‘Cheap Nature’ — profitability, productivity, competition, individualised consumer goods. To meet the demands of the capitalist market and the GND, more mines will have to disfigure the face of the Earth at a velocity determined by the pursuit for mushrooming profit rates.

The particular areas surrounding such rare-earth mines can be termed ‘sacrifice zones’, because the toxic pollutants generated by the operation of these mines have adverse environmental effects on nearby communities, often impoverished and racialised. These sacrifice zones in the hinterlands, like Inner Mongolia in China, are characterised contaminated waterways, degraded soil fertility and rising mortality rates.

Given that major renewable energy supply chains go through large swathes of Indigenous lands in Australia, Bolivia, Canada and Chile, how can our notions of Indigenous justice be made coherent with the imposition of thousands of sacrifice zones on these communities? The CJC in Australia have tried to resolve this tension by endorsing the vision of decolonisation as detailed in the Sovereign Union’s ‘Manifesto of Demands’. The manifesto demands full ownership of ‘all revenues raised from the past, present and future exploitation of the natural resources’ and that all mining projects require the ‘free, prior and informed consent of each Nation concerned’. The CJC’s support for these demands in their tentative GND proposal demonstrates their sincere commitment to Aboriginal sovereignty. Nevertheless, it also exhibits a quixotic disposition concerning how they understand the hard limits of capitalism. If politically feasible at all, these demands will occasion both an exorbitant rise in mining overhead costs and the abolition of mining company profits altogether. Yet the ‘critical minerals’ industry is defined by oversaturated world markets, which necessitates bargain-basement production costs to remain operational. For instance, lithium has been experiencing a global glut, which caused prices in 2019 to tumble by 70% despite supply cuts, and prices are expected to drop lower due to intensifying competition and pricing pressure. Materialising the Sovereign Union’s demands under capitalism would lead to a significant overvaluation of Australian minerals on world markets, thus rendering Australia’s mining operations unviable and eliminating an essential source of tax revenue needed for so-called progressive reforms. It would also deprive Aboriginal communities of those mining profits too. Instead, the renewable energy transition under capitalism will likely encourage further competitive scrambles to set up mines, entailing the cutting of regulatory corners, wanton disregard for Traditional Owners and the unabashed destruction of the local ecosystems.

There are also many uncertainties regarding the hopes for a JG in Australia, and how that will tie in with the GND’s implementation. Its proponents argue that the necessity of new green jobs will drastically reduce un(der)employment, addressing i) the prevalence of un(der)employment following the capitalist restructuring of the domestic labour market since the 1970s, and ii) the rise in unemployment following a phase out of carbon-intensive industries, like coal-fired power stations. However, there will be few jobs available during the transition relative to future un(der)employment levels.

For starters, the fastest growing sector in Australia during the global renewable energy transition will be mining. However, mining in Australia today is a highly-computerised, capital-intensive industry and the extra jobs created by the energy transition will barely plug the un(der)employment hole. Furthermore, the mining industry in Australia pays higher remuneration to non-managerial workers compared to all other industries, at around an average of $2635 per week. Since a JG can only employ workers at the minimum wage in order to avoid distorting the private sector labour market, those choosing to work under the JG would inevitably be denied work in the mining industry.

Well, how about the manufacturing of wind turbines, solar panels and lithium-ion batteries? These industries have already been engulfed by blistering competition, overproduction, overaccumulation, perpetual rationalisation and tax incentivisation, leaving no latitude for Australia to seriously enter these markets. Firstly, competition and overcapacity in wind turbine manufacturing has severed turbine prices and operating profits over the past decade, inducing vanguard manufacturers in Europe like Vestas and Siemens Gamesa to rationalise production by retrenching workers last year. Secondly, China has been selling off its domestic oversupply of key solar components by flooding world markets since last year, heaping further competition into the profit-strained solar equipment industry, which already demands constant productivity enhancements. Thirdly, China also dominates the global supply chain of lithium-ion battery production, outcompeting the US and Europe’s attempts to penetrate the market despite receiving heavy government support.

That’s not to suggest a GND wouldn’t increase employment. According to a University of Technology Sydney study published last year, the renewable energy transition in Australia would create 20,000 new jobs, with half in temporary construction and installation jobs, while the other half involves technicians and labourers in long-term operation and maintenance positions. Maybe ‘green steel’ manufacturing drawing on cheap labour in central Queensland and the Hunter Valley, and the marketised expansion of Aboriginal land management through carbon credit trading could also add tens of thousands more jobs to that figure. Other than that, commercially viable job-creation opportunities in the renewables transition are scant.

Within much of the GND’s popular appeal lies another failure: it is fundamentally retrograde, waxing nostalgic over the postwar social compromise in advanced capitalist economies whilst ignoring the material constraints of the post-1970s ‘long downturn’. The possibility of a return to capitalism’s ‘golden age’ is contingent on historical conditions which are long gone: high labour demand in the manufacturing sector, soaring international demand for consumer durables in standardised product markets, accelerating rates of productivity growth, burgeoning profit rates, the original Bretton Woods system of fixed exchange rates, and high-density, militant unions.

A new New Deal is neither possible nor desirable. The only deal that workers will get from the GND is a raw one. To paraphrase Marx, the (renewables) revolution of the 21st century cannot take its poetry from the past but only from the future. It must strip away its superstitions for the past — the fantastical longing for a worker-friendly bourgeois state — and we must let the dead bury their dead.