The term ‘greenwashing’ was coined in 1986 by Jay Westerveld, an environmentalist who visited the Beachcomber Island Resort while on a surfing trip to Fiji. The resort urged patrons to reuse towels to ‘reduce ecological damage and help the environment’, while simultaneously expanding its premises into the natural surrounds at the forefront of a pollution-heavy tourism industry. Of course, reusing towels would also reduce cleaning costs for the burgeoning establishment, which is now worth $15.95 million.

Greenwashing has since been widely employed to bolster the public image of amoral entities attempting to exploit the growing prominence of environmentalism in the global consciousness. Even Saudi Arabia, the world’s top oil exporter, attempted to greenwash its reputation by pledging to plant 10 billion trees to offset carbon emissions in 2021.

At the University of Sydney, a culture of greenwashing becomes evident in the stark contrast between public posturing about sustainability and the reality of its unpublished $3.41 billion investment portfolio. Indeed, when examined in light of the hundreds of millions financing fossil fuel-ridden equity funds, USyd’s so-called sustainability plans and commitment to edible plates on campus amount to nothing more than empty promises: public relations measures utterly soaked in greenwash.

Untangling the web of bureaucracy

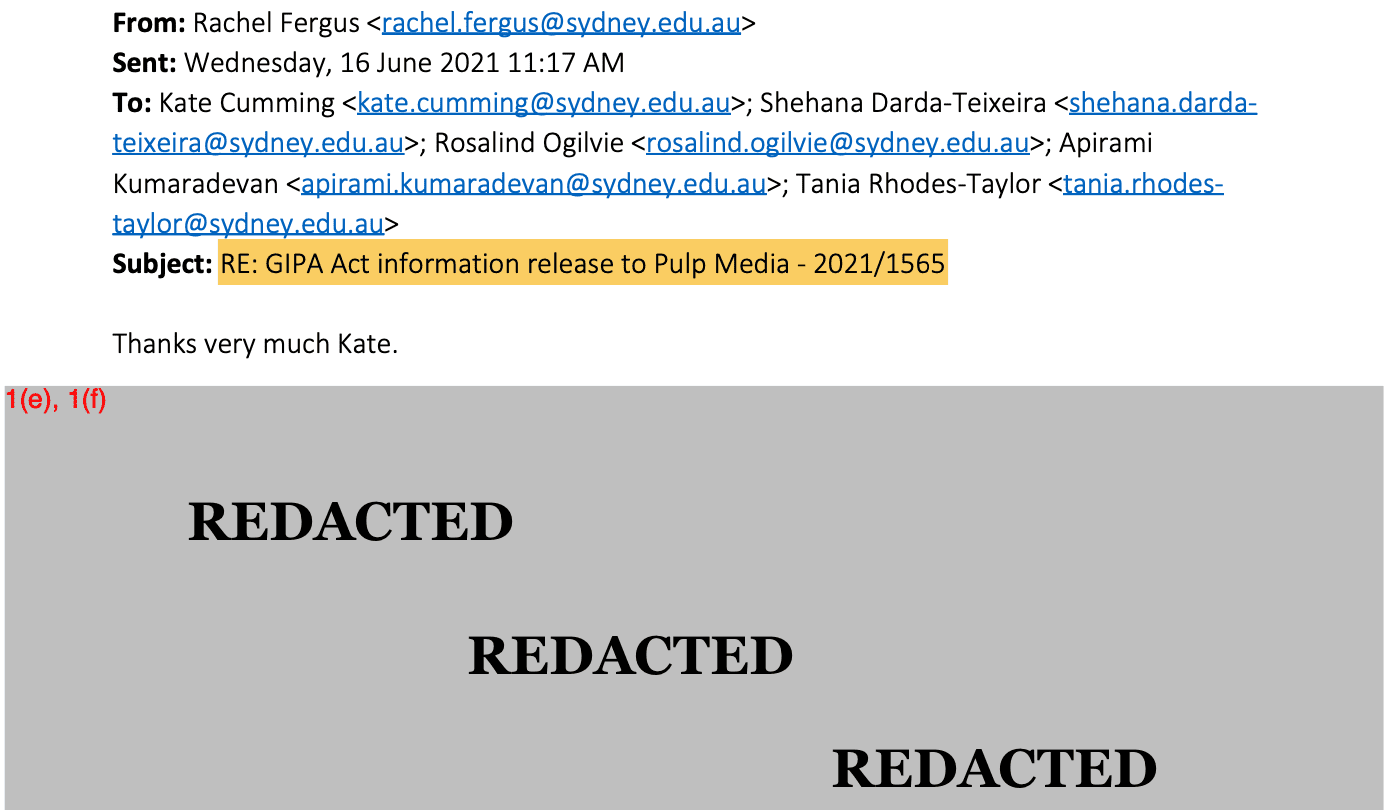

USyd’s investment portfolio is closely guarded by public relations professionals and bureaucrats, only accessible by a ‘Government Information Public Access’ (GIPA) application. Emails released to Honi under GIPA legislation reveal the layers of bureaucracy complicit in USyd’s greenwashing.

Immediately after Pulp Media requested access to the investment portfolio on 29 April 2021, USyd’s in-house GIPA team alerted the Vice Principal of External Relations, Director of Media and Public Relations, and Senior Media Advisor of the application. Background research had been conducted on the applicant, seemingly to assess the threat to public image: “the University has received an application… [from a student] who appears to be an editor with Pulp Media and has written for Honi Soit in the past”.

Consequent emails reveal that, between the application date in April and the information release on 18 June, USyd’s media team made preparations to announce a change to its investment strategy. By 2 June, drafts of a brand new ‘Sustainability Investment Strategy’ (SIS) were being revised and edited. The strategy was launched on 9 June in coordination with the publication of a puff piece in The Australian organised by USyd Media, headlined ‘University of Sydney is doing its bit for sustainable investment’.

On 16 June, the GIPA team checked with USyd’s Senior Media Advisor before releasing the portfolio. In emails which have been largely redacted, the Advisor appeared to stall the release for two days, during which communications (again, mostly redacted) mentioned the SIS and Honi Soit’s article critiquing the strategy.

USyd’s dirty investments

USyd holds $3.41 billion in three separate pools: a long term, medium term and short term fund. The contents of the long and medium term portfolios, which were released to Honi as of 30 November 2021, reveal hundreds of millions indirectly invested in fossil fuel companies.

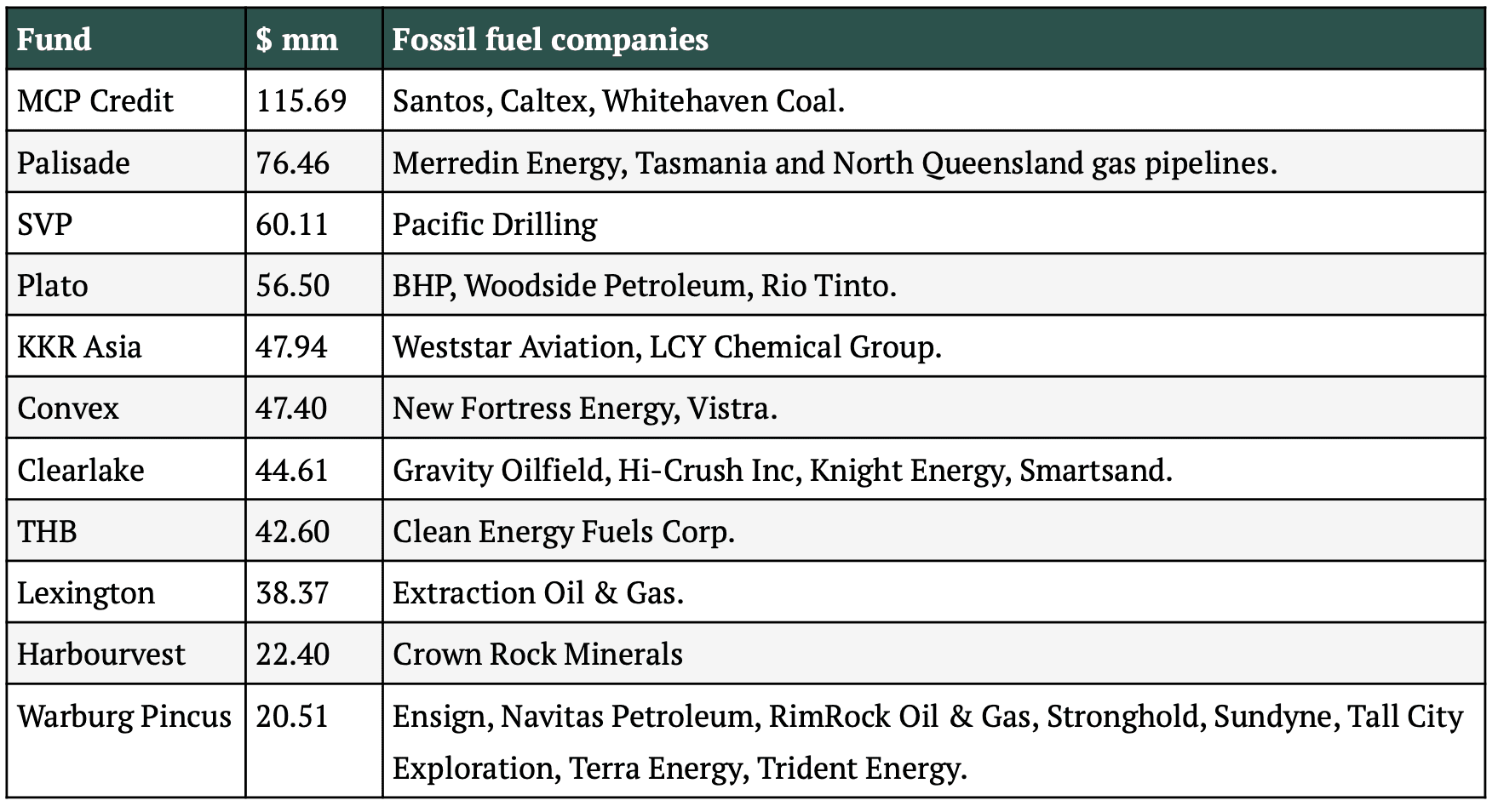

The vast majority of the $2.08 billion that Honi was able to access is held in externally managed private funds, the majority of which establish their operations in the Cayman Islands for tax evasion purposes. Many of these funds use their investors’ contributions to invest in fossil fuel companies. Although such funds do not make their holdings publicly available, various shareholder documents illuminate the makeup of a select few. For example, USyd had $56.5 million in Plato Investment Management, which invests in BHP, Woodside Petroleum and Rio Tinto, with BHP accounting for 13.2% of the $2.2 billion fund’s annual yield.

The following table overviews the funds that Honi was able to link to fossil fuel companies at the time of publication. The values provided represent the amount of money USyd has in each investment fund. Cited companies are ones which those respective funds support financially.

Additionally, $88.22 million was linked to Amazon, and $47.11 million to French betting company Francaise de Jeux. Multiple funds also name Westpac, Commbank, NAB, and ANZ in their top holdings, who collectively loaned $7 billion to 33 new or expansionary fossil fuel projects from 2016 to 2019.

Ultimately, the limited data available on private portfolios means the true extent of USyd’s financial ties to the fossil fuel industry is still unknown.

Sustainability Investment Strategy

The SIS promised to “increase investment in sustainable solutions and exclude fossil fuel companies with inadequate transition plans from investments.” The ultimate objective of the SIS is alignment with the UN Sustainable Development Goals by 2030 and the University’s broader aim for Net Zero by 2050 – an unambitious and tepid aim for a non-industrial and wealthy institution that houses the very scientists at the forefront of climate research and academia.

The announcement, however, did not establish specific aims for the portfolio, nor indicate how USyd’s investment strategy would be amended. Rather, it promised, “by the end of 2021, the University will have established and communicated clear milestones and methodologies”.

10 months after the announcement, no milestones have been communicated. After being contacted to explain this by Honi, a University spokesperson said “work is well underway, with updates to our Investment Policy drafted and expected to be presented to the May 2022 meeting of the Investment Subcommittee of Senate for approval, and actions to divest already undertaken. We will be able to communicate our agreed milestones and methodologies to our community once the revised policy has been approved.”

The differences between USyd’s portfolio at December 2020 and November 2021 indicates one notable instance of divestment, with funds pulled from BHP-linked Martin Currie Equity. However, sometime in 2021, $26.78 million was invested in Staude Capital, who have “minimal consideration of environmental and social elements within their investment process” according to an independent review.

University of Sydney Union embarrassed by investments

As of 31 March 2022, the USU held $2.89 million in the Australian Foundation Investment Company (AFIC). The company advertises BHP, Rio Tinto and Woodside Petroleum as comprising 8%, 2.5%, and 1.2% of its holdings respectively. Investment in AFIC comprises 60.6% of the USU’s total portfolio, with the remaining funds held in Australian Ethical Investment.

Yet the USU attempted to strategically undercut any breaking information about its portfolio. After Honi’s initial inquiry on 23 March, the USU stalled disclosing the data until it could preempt negative press with a 20 April media release publicly admitting a portion of its investments were “unethical”. Like the SIS, the announcement was vague and full of PR spin, promising to review its investment strategy “with an eye towards developing a future ESG [Environmental, Social and Governance] framework”.

Worryingly, our elected student board members – who enjoy annual salaries ranging from $4,900 to $29,900 – were seemingly unaware of the contents of the million-dollar portfolio they presided over; it was only after Honi’s inquiry that the USU began to review its holdings. In August 2020, the USU Board unanimously passed a motion to call on USyd to divest from fossil fuels, apparently ignorant of the dirty investments under their very noses. Seemingly, then, the USU’s hypocritical greenwashing was likely a product of sheer incompetence rather than any deliberate attempts to deceive the public.

Worryingly, our elected student board members – who enjoy annual salaries ranging from $4,900 to $29,900 – were seemingly unaware of the contents of the million-dollar portfolio they presided over; it was only after Honi’s inquiry that the USU began to review its holdings. In August 2020, the USU Board unanimously passed a motion to call on USyd to divest from fossil fuels, apparently ignorant to the dirty investments under their very noses.

The findings also contradict much of the USU’s work surrounding sustainability more broadly. In 2021, the USU trialled edible plates in a progressive move to reduce waste and, just this year, CEO Andrew Mills banned clubs and societies from producing stickers.

Arguably, the USU’s investments somewhat undermine the legitimacy of its flagship sustainability festival, EnviroWeek. Held from 5–7 April this year, EnviroWeek was advertised with the tagline “Sustainability in Action”. The USU’s website describes the week as “a time for action, education and change as we recognise the growing environmental and climate crisis the world faces”. The festival included sustainability lectures, plant-based food trucks, bake sales and floral treasure hunts – all while $338,130 of the USU’s funds were effectively financing BHP, Rio Tinto, and Woodside Petroleum.

EnviroWeek included sustainability lectures, plant-based food trucks, bake sales and floral treasure hunts – all while $338,130 of the USU’s funds were effectively financing BHP, Rio Tinto, and Woodside Petroleum.

Signs of progress?

A 2019 GIPA application by the now inactive advocacy group, Fossil Free USyd, revealed that the University had previously directly invested in fossil fuel corporations BHP, Woodside Petroleum, Santos, and Whitehaven Coal. Today, USyd no longer invests in individual companies, instead abdicating responsibility to fund managers. However, USyd would undoubtedly be aware of a fund’s holdings prior to investment, and the financial support for fossil fuels is materially identical. Rather, this shift in strategy in itself is a form of greenwash: halting direct investment merely serves to distance USyd from immediate association with ethically questionable companies.

It would be remiss to ignore the progress that USyd has made. As of 30 September 2020, the portfolio’s ratio of carbon emissions to revenue had decreased by 50% from 2014.

According to a University spokesperson, USyd’s revised investment policy “includes metrics related to our commitment to exclude publicly listed equity investments that are significantly involved in fossil fuels (defined as companies that generate 20% or more of their revenue from the extraction of, or generation of power from, fossil fuels), unless companies or investment managers can demonstrate their genuine alignment with a low carbon transition.”

USyd apparently instructed fund managers “to divest a number of non-qualifying investments including Ampol, Oil Search, Santos and Woodside Petroleum.”

While admirable, such progress is arguably inadequate, and long overdue. According to the Intergovernmental Panel on Climate Change’s (IPCC) 2022 report, humanity has a near-zero chance of limiting global warming to 1.5oC above pre-industrial levels, with the phasing out of fossil fuel infrastructure cited as a key step in meeting this goal.

If USyd is truly committed to sustainability, it must divest the hundreds of millions it uses to finance the very companies driving climate change. The funds in USyd and the USU’s portfolios is money that belongs to students and the citizens it purports to serve as a publicly-owned institution; it should not be used to poison the environment.

To date, USyd has operated its investments relatively unscrutinised. At the very least, students have a right to know exactly what this money is being invested in. It should not require an arduous GIPA process to uncover the portfolio’s contents, especially when those contents shape the future of the planet.

It seems USyd is less intent on being sustainable than it is on appearing sustainable. Yet, there is a clear path forward to reverse this culture of greenwashing. The University must engage in swift and comprehensive divestment; the advent of sustainable investment funds provides viable means to do so. The positive impact of divestment is not restricted to the financial impediment of fossil fuel companies; it incentivises carbon-intensive corporations to transition to sustainable practices and sends a powerful message that unclean energy sources have no economic future.

The bottom line is simple: USyd is sinking millions of dollars into a fossil fuel industry responsible for killing the planet, and no amount of press releases, sanctimony, or edible plates can wash that reality clean.