I became fascinated with the National Energy Market (NEM) when I joined a Facebook group called NEM Watch late last year. Having observed from the shadows for several months, I now understand why 4000 others have their eyes trained on its movements. Watching the NEM is like watching the dramatic dance between good (renewables) and evil (fossil fuels). I can’t get enough. So please, take a seat. The show’s already started.

We need a revolution in the global energy sector, but in the chaos of our struggle, it’s hard to imagine what that looks like. Between our demands for a just transition, it is helpful to evaluate where we currently stand to come up with new strategies. While the picture is still bleak, there have been some positive developments in the NEM. But what is the NEM? How does it work? And most importantly, how might we leverage it and its associated institutions to ensure a liveable planet for all?

The NEM is the world’s longest power system. It refers to both the physical infrastructure and the market through which electricity generators and utility companies trade. Approximately $16 billion is traded annually, meeting the electricity needs of 20 million end-users. The transmission lines run from Port Douglas in Queensland to Hobart in Tasmania. It runs through New South Wales and Victoria and stretches west to South Australia. While significant, any valid discussion of the NEM recognises that it does not serve Western Australia or the Northern Territory. Accordingly, the national energy landscape will not undergo a complete transformation with the NEM’s reform alone.

With that in mind, let’s break down how the NEM works. First, let’s introduce the Australian Energy Market Operator (AEMO). This public-private body coordinates all transactions across the NEM. Its primary mandate relating to the NEM is to ensure electricity supply and demand are matched at all times. It also ensures electricity flows in case of a generator shutdown (system security) and does so consistently, even during peaks (system reliability).

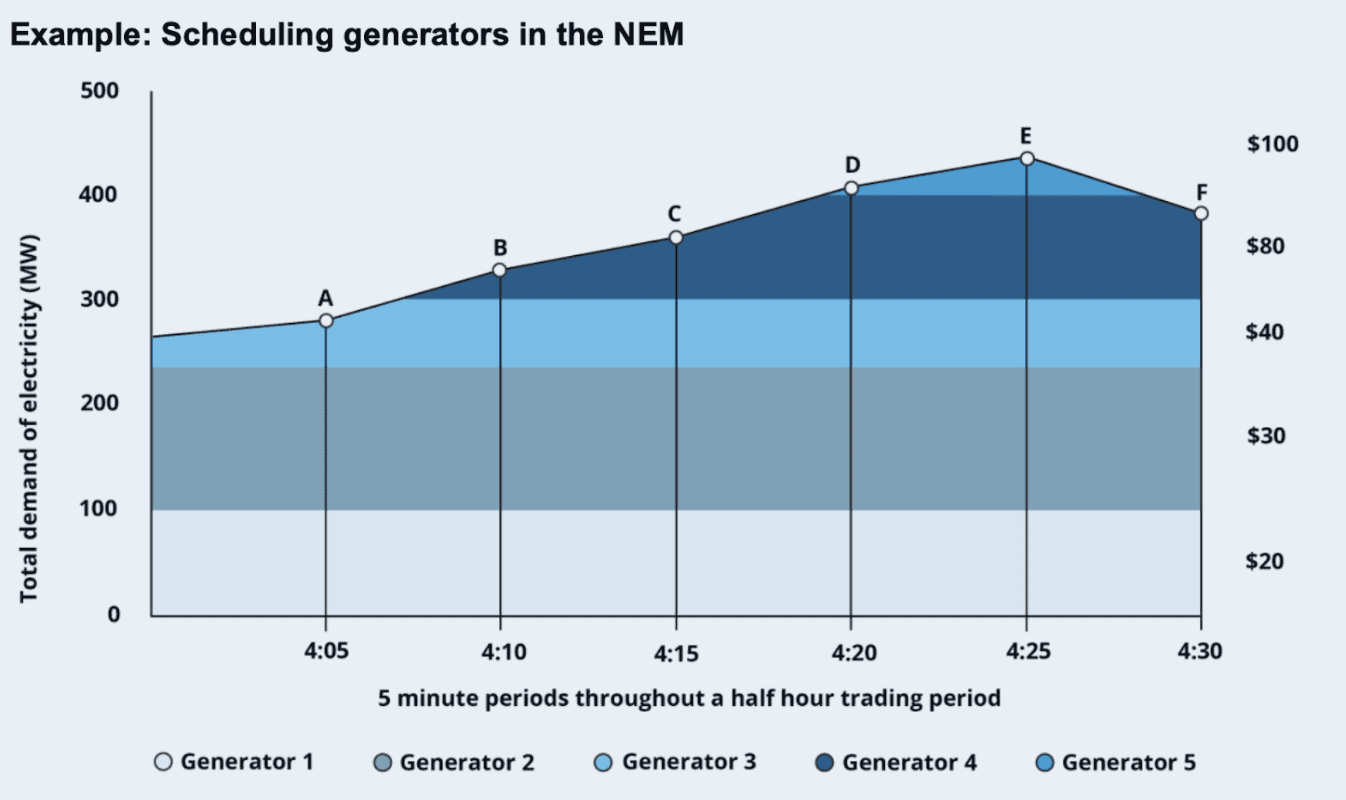

Every day, electricity generators inform the AEMO how much energy they are willing to trade and at what price. In the NEM, the day is divided up into five-minute intervals. Energy retailers (like AGL, Enova Energy, and Powershop) and wholesale buyers (like aluminium smelters) indicate how much they will buy and for what price during each interval. Accordingly, the AEMO gives generators the order to meet the power demand required by energy retailers every five minutes. They start with the lowest bidding generator and go down the list until demand is met (see fig. 1). The price paid to generators is called the spot price.

As renewables have low operating costs, they almost always outcompete fossil fuel generators, becoming the primary source of energy supply except during peak periods (comparing Generator 1, fig. 1 and Generator 5, fig. 1), and edge fossil fuel providers out of market revenue.

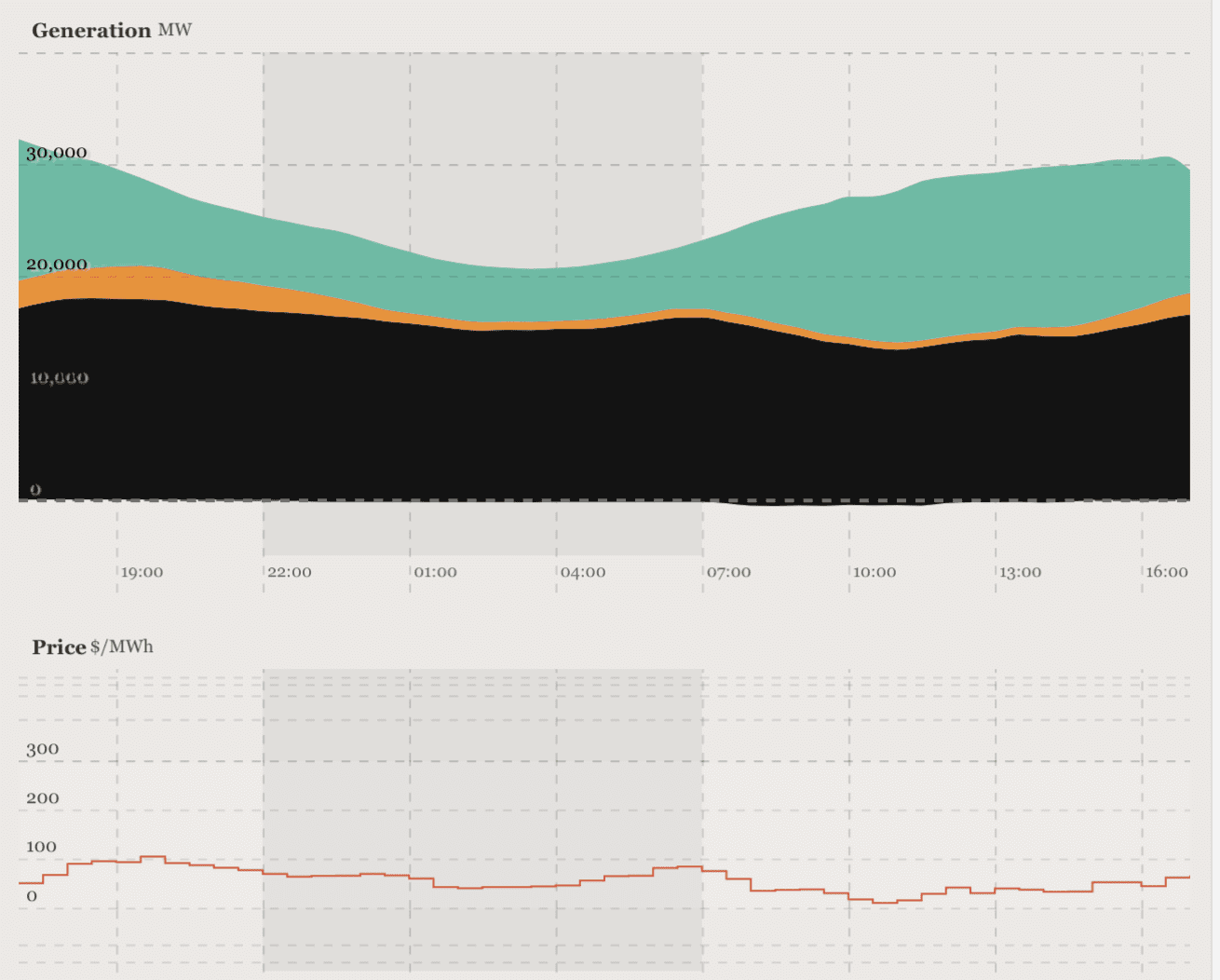

We can see the spot prices of electricity being traded on the NEM through the publicly available Open NEM project. A breakdown of the energy source (solar, wind, coal, etc.) can also be viewed. When renewable generators are running, the spot price goes down (fig. 2). In the long term, this results in lower annual income for fossil fuel generators, This market trend has been behind the early closure of coal-fired power plants like Lidell and Eraring.

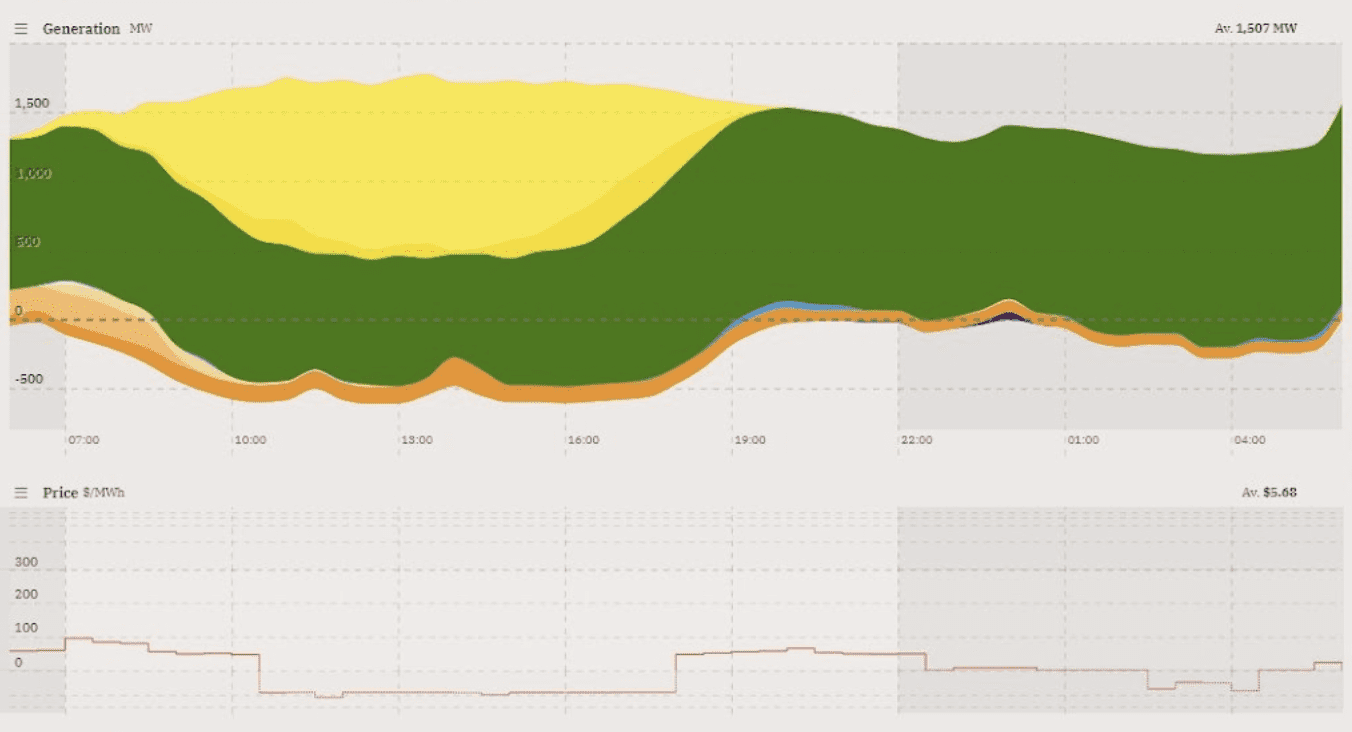

Looking at South Australia, the future is even brighter. On 11 October 2020, South Australia became the first state to be 100 per cent renewably powered for 24 hours ( which should be celebrated as a national holiday, in my humble opinion). From 23 to 29 December 2021, the NEM was even able to power the entire state using renewable energy alone! However, on most days we see approximately 60 per cent renewable generation, with the gap generally met by gas and imports across state borders.

So, what is required to make the entire NEM look more like South Australia on its best day (see fig. 3)? Clearly, we need more renewable energy generators; this is nothing new. Additionally, we might look to some other features of the NEM previously hinted at, but not discussed.

Electricity is distributed across the NEM through a transmission network (think highways) and a distribution network (think streets). Transmission networks allow electricity to flow across large distances and even interstate. While the NEM is currently an interstate network, states keep to themselves for most of the day (but not all) because of power loss in the transmission cables. The further the distance, the greater the energy loss and therefore the amount needed to meet demand at its destination. By investing in low-loss high-power transmission lines, energy can be used in other states with less need to compensate for the transmission losses.

We could also make the NEM truly national by expanding to Perth and Alice Springs, connecting the entire country and eliminating intermittency concerns associated with renewables. When Adelaide isn’t windy, Perth and Geelong could compensate. For all the same reasons the NEM connected all the state grids on the eastern seaboard in 1998, we should seek its expansion north and west. According to ANU research, the total upgrade and expansion cost will amount to approximately $20 billion.

Our existing infrastructure should also be nationalised as part of the upgrade. Our current transmission and distribution networks are mostly privately owned but have to be heavily regulated to avoid the formation of a natural monopoly. If publicly owned, we could have an operational body manage the grid network rather than a regulatory one.

For the average household, transmission and distribution account for approximately 50 per cent of the energy bill. Lower-income households can ration their energy consumption, but not their use of the transmission and distribution network. If publicly owned, the network’s operation and use could be paid via tax. Lower-income households would effectively be subsidised by higher-income households. Thus, a publicly-owned network would be a valuable first step towards energy justice.

Beyond infrastructure, we might also look towards AEMO’s operational processes. For instance, the five-minute spot price replaced the previous 30-minute average model in October 2021.

Electricity storage, such as batteries and pumped-hydro, benefited greatly from this change. During a demand spike, they can charge high prices to discharge electricity to the grid because of their ability to respond quickly. Accordingly, they are compensated with a large spot price that subsidises their construction cost. If that high price gets averaged across a thirty-minute period, discharging is less lucrative. This seemingly simple change in the AEMO’s market mechanisms had a significant impact on the margins of renewable generators compared to fossil fuel ones.

Perhaps we should investigate one-minute spot prices. Maybe we should directly subsidise any renewably sourced energy. That might allow solar or wind to further outbid coal in the NEM bidding process. Alternatively, we might investigate a carbon tax once more to punish fossil fuel production. Keeping the NEM bidding structure but encouraging state (not federally) owned generator construction could facilitate healthy competition and investment between states.

These suggestions are not specific, but rather a demonstration of how one can make additional demands by understanding the processes at play.

The NEM is a complex beast. This discussion is far from comprehensive but covers several important bases. By understanding how it operates, who owns what, and how its components interact, we can make better-informed demands of it. I hope you’ll join me in watching the NEM. If you do, you’ll see an energy revolution play out quietly in real time. Now, it’s time to make that revolution loud.